Specter Strategy Full Report (20200101-20250701)

免责申明

本内容仅供参考,市场行情波动巨大。请根据自身情况合理操作,作者不承担由此产生的任何损失。

📊 Strategy Overview

This report is produced by https://www.itrade.icu Quantitative Trading Lab.

We utilized real market data combined with a quantitative backtesting engine to evaluate the Specter Strategy over a continuous 5 years and 7 months period, including live trading simulations. The results were outstanding, with a total return of 884,924.84% (20200101-20250701) and an average monthly return of 13,407.95%.

Lookahead Bias Analysis

The strategy was tested for Lookahead Bias, and the results show:

has_bias: No → No lookahead bias detectedbiased_entry_signals: 0 → No future data in entry signalsbiased_exit_signals: 0 → No future data in exit signalsbiased_indicators: None → No biased indicators

This means the strategy does not use future data in backtesting, ensuring that results are not artificially inflated.

Lookahead Analysis

┏━━━━━━━━━━━━━━━━━━━━━━┳━━━━━━━━━━━━━━━━━━━┳━━━━━━━━━━┳━━━━━━━━━━━━━━━┳━━━━━━━━━━━━━━━━━━━━━━┳━━━━━━━━━━━━━━━━━━━━━┳━━━━━━━━━━━━━━━━━━━┓

┃ filename ┃ strategy ┃ has_bias ┃ total_signals ┃ biased_entry_signals ┃ biased_exit_signals ┃ biased_indicators ┃

┡━━━━━━━━━━━━━━━━━━━━━━╇━━━━━━━━━━━━━━━━━━━╇━━━━━━━━━━╇━━━━━━━━━━━━━━━╇━━━━━━━━━━━━━━━━━━━━━━╇━━━━━━━━━━━━━━━━━━━━━╇━━━━━━━━━━━━━━━━━━━┩

│ SpecterStrategyV1.py │ SpecterStrategyV1 │ No │ 20 │ 0 │ 0 │ │

└──────────────────────┴───────────────────┴──────────┴───────────────┴──────────────────────┴─────────────────────┴───────────────────┘2

3

4

5

6

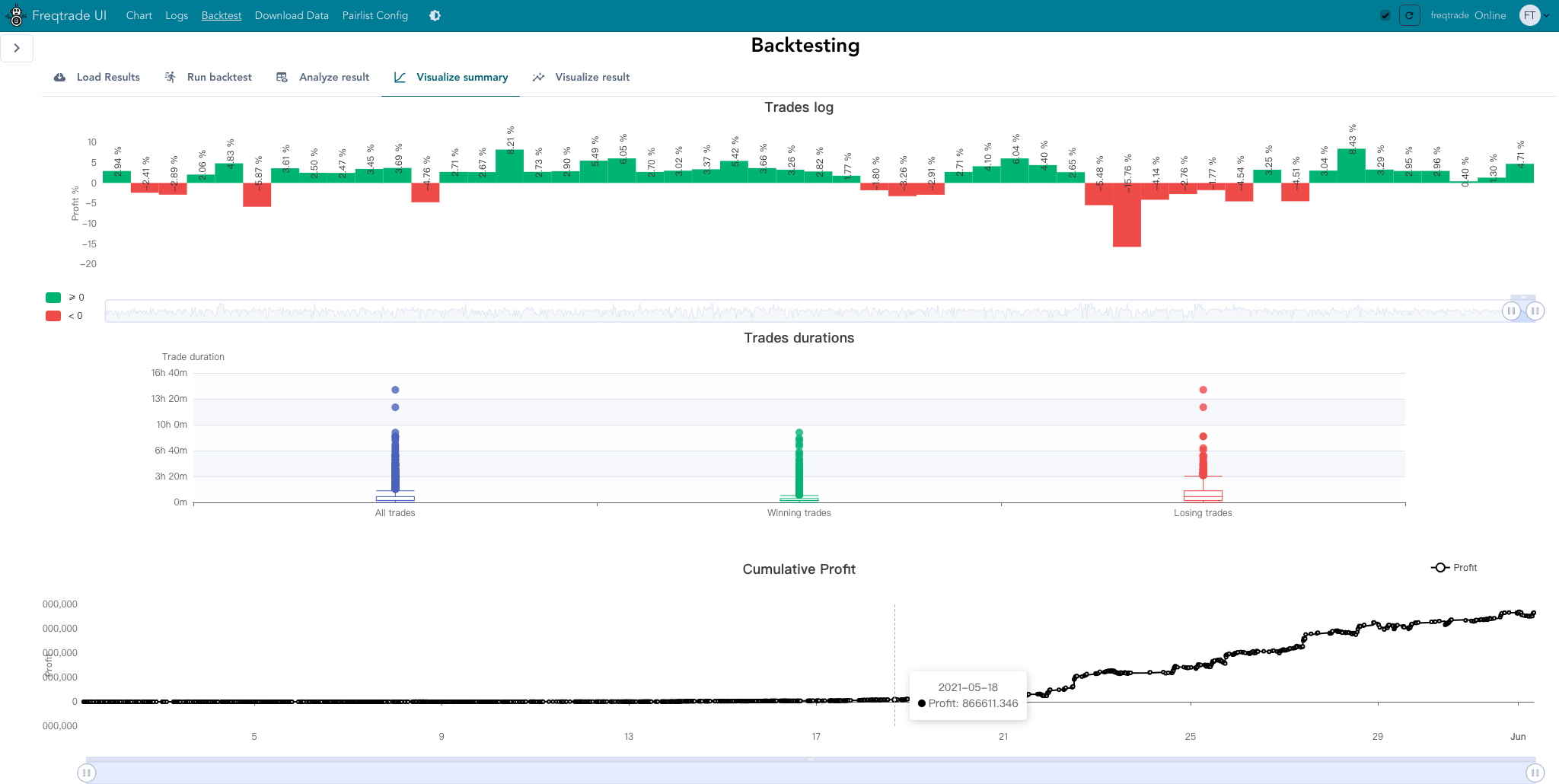

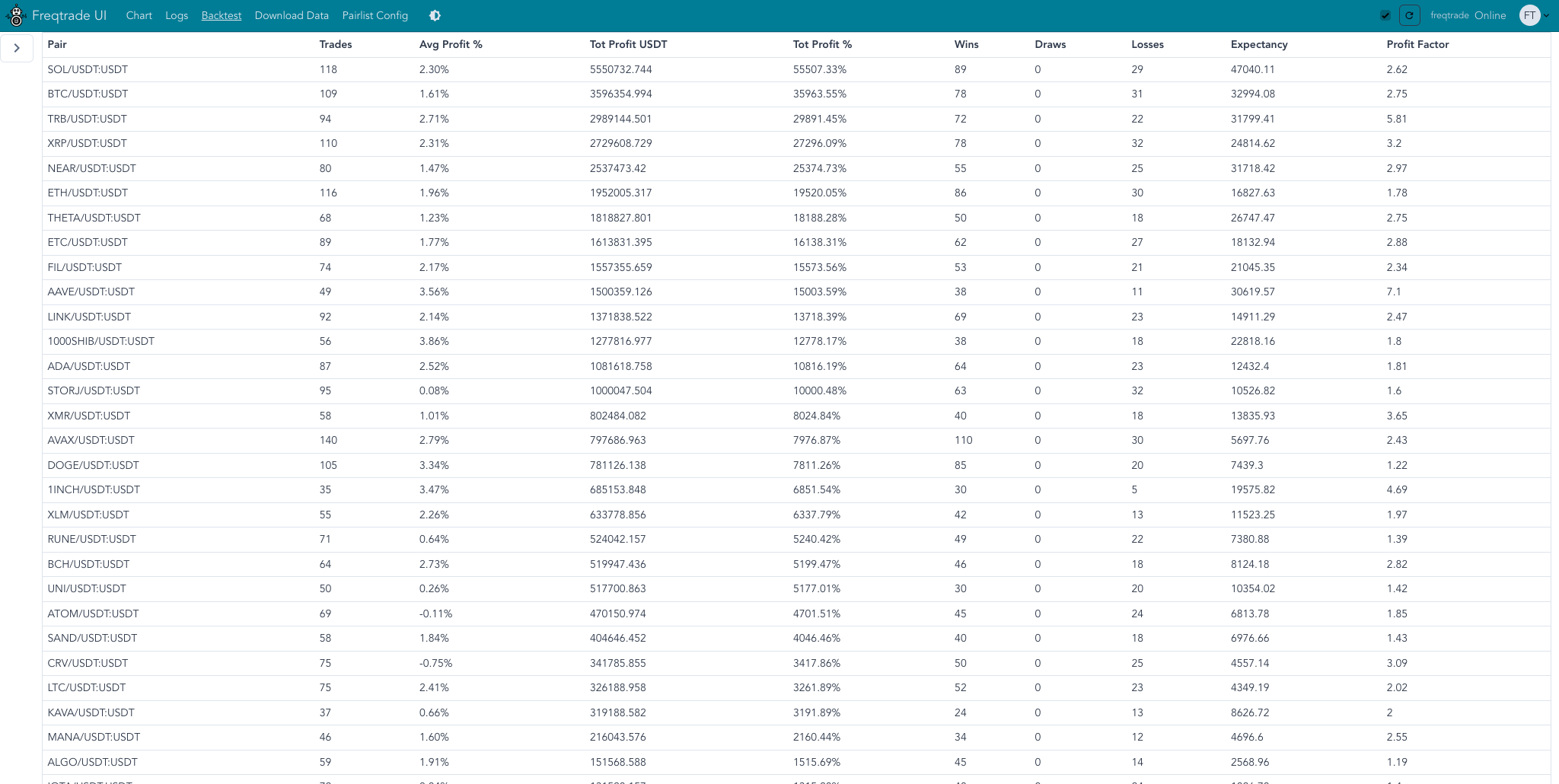

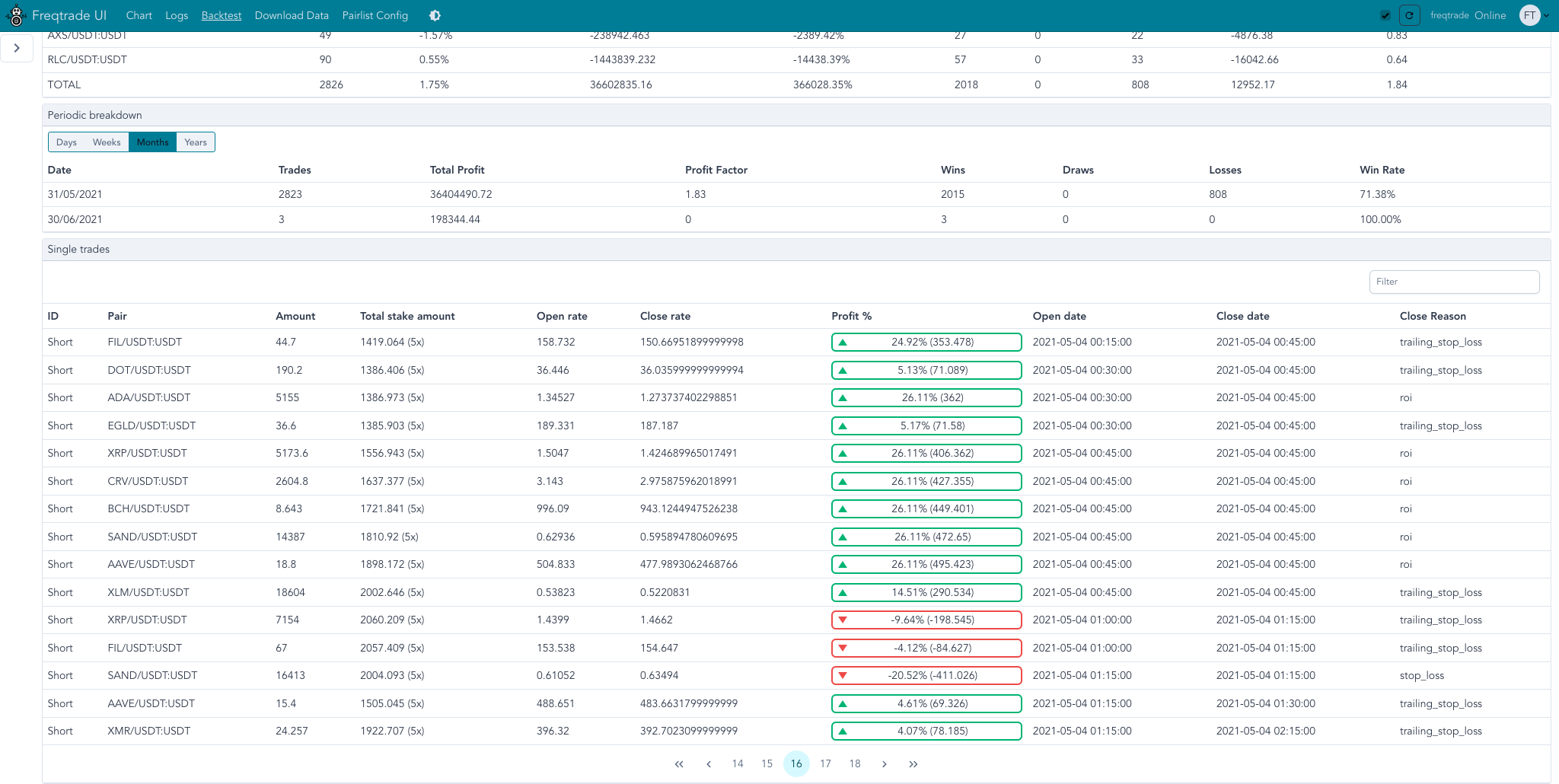

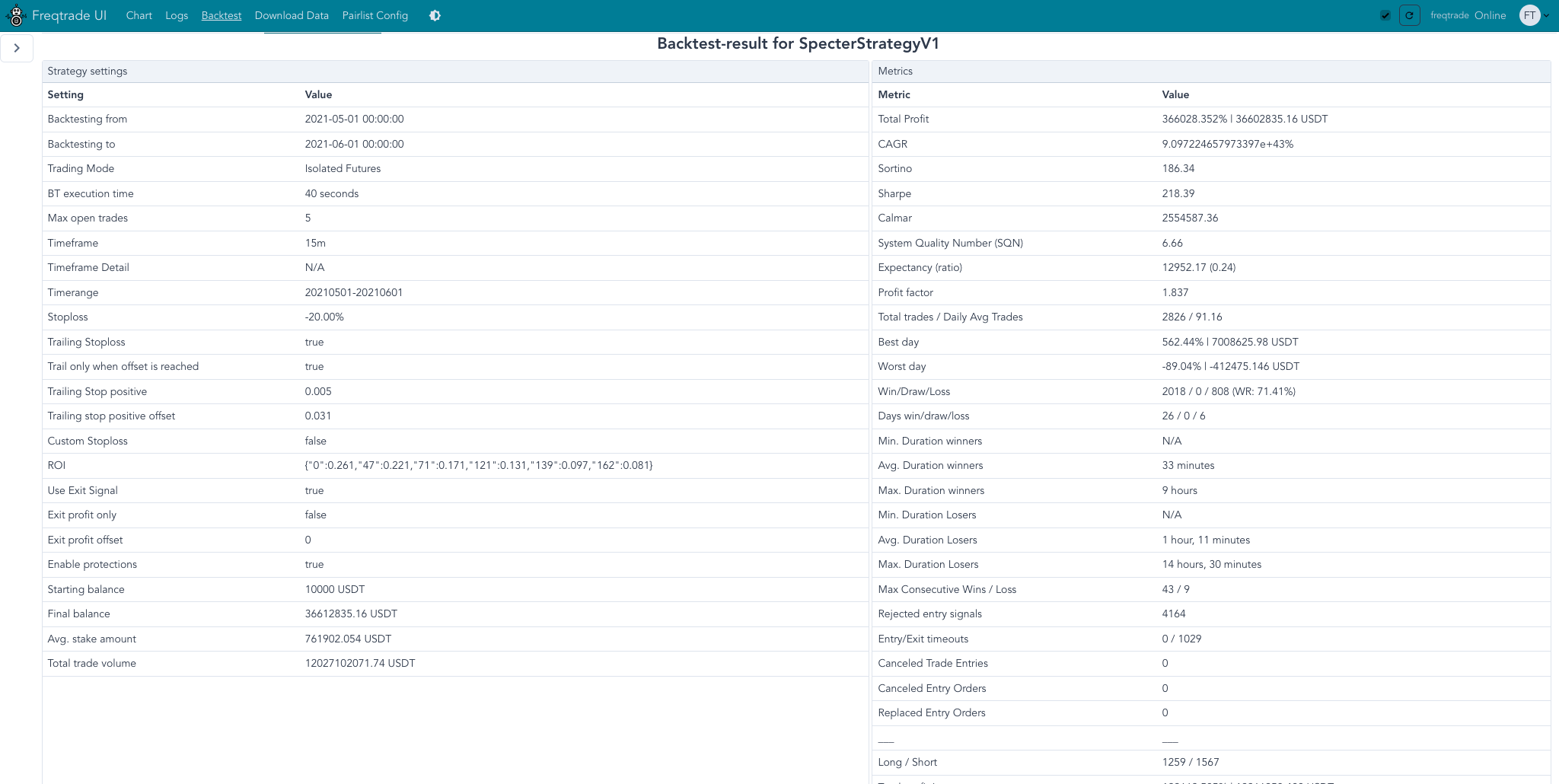

Backtest Report

The current strategy was backtested using data from 20200101-20250801. For detailed reports, see: 👉 Full Monthly Backtest Report

Summary Statistics

| Metric | Value |

|---|---|

| Total Trades | 137,143 |

| Total Return (%) | 884,924.84% |

| Total Profit (USDT) | 88,492,484.05 USDT |

| Avg. Monthly Return (%) | 13,407.95% |

| Avg. Monthly Profit (USDT) | 1,340,795.21 USDT |

| Avg. Win Rate (%) | 65.57% |

| Max Drawdown (%) | 89.52% |

Monthly Statistics

| TimePeriod.MONTHLY | Trades | Avg Profit % | Tot Profit USDT | Tot Profit % | Win% | Drawdown % |

|---|---|---|---|---|---|---|

| 20200101-20200201 | 482 | 1.18 | 18736.834 | 187.37 | 64.5 | 10.74 |

| 20200201-20200301 | 1003 | 1.37 | 113736.63 | 1137.37 | 67.6 | 21.3 |

| 20200301-20200401 | 1091 | 1.19 | 79809.557 | 798.1 | 69.5 | 61.74 |

| 20200401-20200501 | 812 | 0.78 | 21733.448 | 217.33 | 62.6 | 13.23 |

| 20200501-20200601 | 982 | 0.77 | 29287.904 | 292.88 | 61.0 | 23.38 |

| 20200601-20200701 | 825 | 0.12 | 1311.086 | 13.11 | 51.8 | 33.16 |

| 20200701-20200801 | 1264 | 0.62 | 32629.516 | 326.3 | 60.1 | 13.01 |

| 20200801-20200901 | 1601 | 0.7 | 59209.379 | 592.09 | 64.0 | 30.57 |

| 20200901-20201001 | 1692 | 1.3 | 540633.798 | 5406.34 | 67.2 | 19.35 |

| 20201001-20201101 | 1661 | 0.54 | 38120.826 | 381.21 | 62.5 | 20.67 |

| 20201101-20201201 | 2054 | 1.02 | 387607.3 | 3876.07 | 66.5 | 46.35 |

| 20201201-20210101 | 2264 | 0.9 | 348152.101 | 3481.52 | 67.2 | 28.79 |

| 20210101-20210201 | 2838 | 1.31 | 5220450.39 | 52204.5 | 70.4 | 38.17 |

| 20210201-20210301 | 2702 | 1.61 | 14802967.269 | 148029.67 | 72.5 | 14.46 |

| 20210301-20210401 | 2490 | 0.64 | 130963.329 | 1309.63 | 67.3 | 54.31 |

| 20210401-20210501 | 2848 | 0.91 | 801527.397 | 8015.27 | 68.3 | 27.01 |

| 20210501-20210601 | 2826 | 1.75 | 36602835.16 | 366028.35 | 71.4 | 8.83 |

| 20210601-20210701 | 2340 | 1.03 | 627307.644 | 6273.08 | 70.3 | 44.74 |

| 20210701-20210801 | 2135 | 0.46 | 34077.682 | 340.78 | 65.4 | 48.63 |

| 20210801-20210901 | 2423 | 0.83 | 307988.23 | 3079.88 | 67.9 | 44.33 |

| 20210901-20211001 | 2314 | 0.98 | 532773.106 | 5327.73 | 67.2 | 32.25 |

| 20211001-20211101 | 2198 | 0.92 | 365833.144 | 3658.33 | 65.9 | 26.75 |

| 20211101-20211201 | 2472 | 0.88 | 436417.057 | 4364.17 | 66.7 | 22.19 |

| 20211201-20220101 | 2420 | 0.65 | 138162.462 | 1381.62 | 66.2 | 33.11 |

| 20220101-20220201 | 2170 | 0.4 | 27424.711 | 274.25 | 65.4 | 46.07 |

| 20220201-20220301 | 1824 | 1.21 | 517493.964 | 5174.94 | 69.3 | 13.18 |

| 20220301-20220401 | 2253 | 0.77 | 197295.98 | 1972.96 | 65.9 | 41.24 |

| 20220401-20220501 | 1922 | 1.09 | 442062.876 | 4420.63 | 67.3 | 13.27 |

| 20220501-20220601 | 2648 | 1.19 | 2074561.869 | 20745.62 | 69.1 | 18.34 |

| 20220601-20220701 | 2357 | 1.42 | 3361331.973 | 33613.32 | 70.0 | 19.25 |

| 20220701-20220801 | 2345 | 0.51 | 60248.934 | 602.49 | 67.3 | 56.61 |

| 20220801-20220901 | 1947 | 0.81 | 155804.914 | 1558.05 | 66.0 | 41.86 |

| 20220901-20221001 | 2085 | 0.58 | 63866.751 | 638.67 | 63.7 | 38.27 |

| 20221001-20221101 | 1719 | 0.08 | 1044.142 | 10.44 | 57.6 | 46.62 |

| 20221101-20221201 | 2168 | 1.5 | 2613676.661 | 26136.77 | 64.3 | 45.1 |

| 20221201-20230101 | 1555 | 0.76 | 75485.876 | 754.86 | 57.6 | 12.72 |

| 20230101-20230201 | 2050 | 0.92 | 231484.443 | 2314.84 | 63.0 | 27.68 |

| 20230201-20230301 | 2062 | 0.96 | 341564.571 | 3415.65 | 65.1 | 26.35 |

| 20230301-20230401 | 2065 | 1.43 | 2131485.054 | 21314.85 | 65.1 | 19.32 |

| 20230401-20230501 | 1842 | 0.82 | 152891.005 | 1528.91 | 62.9 | 6.43 |

| 20230501-20230601 | 1685 | 0.64 | 59570.723 | 595.71 | 56.7 | 30.8 |

| 20230601-20230701 | 2058 | 0.97 | 324920.033 | 3249.2 | 61.7 | 26.93 |

| 20230701-20230801 | 1891 | 0.75 | 110940.473 | 1109.4 | 58.9 | 18.5 |

| 20230801-20230901 | 1686 | 0.6 | 43398.52 | 433.99 | 55.9 | 82.43 |

| 20230901-20231001 | 1536 | 0.54 | 36174.978 | 361.75 | 56.8 | 20.06 |

| 20231101-20231201 | 2551 | 1.06 | 1325340.282 | 13253.4 | 66.1 | 33.59 |

| 20231201-20240101 | 2859 | 0.9 | 939296.139 | 9392.96 | 66.0 | 16.93 |

| 20240101-20240201 | 2517 | 1.11 | 1764706.868 | 17647.07 | 65.2 | 39.17 |

| 20240201-20240301 | 2418 | 0.84 | 342335.329 | 3423.35 | 64.0 | 13.58 |

| 20240301-20240401 | 2763 | 1.19 | 3062445.068 | 30624.45 | 67.7 | 21.4 |

| 20240401-20240501 | 2358 | 0.72 | 180065.984 | 1800.66 | 67.5 | 30.19 |

| 20240501-20240601 | 2345 | 0.48 | 57143.16 | 571.43 | 61.1 | 35.56 |

| 20240601-20240701 | 2014 | 0.52 | 51455.075 | 514.55 | 62.2 | 29.69 |

| 20240701-20240801 | 2284 | 0.7 | 163918.08 | 1639.18 | 65.2 | 16.37 |

| 20240801-20240901 | 2105 | 1.5 | 3131248.636 | 31312.49 | 67.7 | 14.16 |

| 20240901-20241001 | 2134 | 0.29 | 16519.717 | 165.2 | 62.4 | 45.8 |

| 20241001-20241101 | 2199 | 0.39 | 33472.323 | 334.72 | 62.9 | 62.23 |

| 20241101-20241201 | 2795 | 1.02 | 1279958.772 | 12799.59 | 69.3 | 43.19 |

| 20241201-20250101 | 2758 | 0.85 | 504206.773 | 5042.07 | 68.3 | 48.36 |

| 20250101-20250201 | 2245 | 0.73 | 146421.885 | 1464.22 | 67.3 | 58.0 |

| 20250201-20250301 | 2229 | 0.57 | 61000.067 | 610.0 | 67.9 | 89.52 |

| 20250301-20250401 | 2298 | 0.69 | 141539.626 | 1415.4 | 65.8 | 42.73 |

| 20250401-20250501 | 2310 | 0.66 | 133272.079 | 1332.72 | 66.9 | 49.34 |

| 20250501-20250601 | 2302 | 0.89 | 391715.409 | 3917.15 | 67.4 | 22.95 |

| 20250601-20250701 | 1928 | 0.53 | 48012.819 | 480.13 | 63.4 | 20.03 |

| 20250701-20250801 | 2126 | 0.36 | 23410.262 | 234.1 | 62.9 | 51.91 |

🆚 Specter Strategy Source Code

支持其他平台?

本策略目前基于 Freqtrade 开发,但如果您希望在 TradingView(Pine Script)、股票交易平台(MetaTrader、Amibroker 等)、期货系统 上使用,可以通过以下方法轻松实现:

- ✅ 使用 AI 工具(推荐)

您可以使用 GPT 等大模型工具,将策略源码作为输入,提示 AI 将其转换为目标平台的策略语言。 - ✅ 适用场景

- TradingView(Pine Script) → 实现信号提醒和自动化交易

- MetaTrader(MQL4/MQL5) → 股票、外汇、期货自动交易

- Amibroker、NinjaTrader 等 → 技术分析和交易自动化

注意:

转换后请务必在目标平台进行 回测验证,确保逻辑一致。

策略常见问答(FAQ)

在那种行情下,敢问阁下是否爆仓?仓位能剩多少?

✅ 回撤高并不意味着策略不好,而是测试 足够真实且严格,没有弄虚作假。

不过,市场是动态的,实盘表现可能优于或劣于回测结果,用户需自行承担风险。

运行期间产生的任何收益或亏损,均由用户自行承担。

- 接受长期回测逻辑,而非短线暴利幻想

- 懂得风险管理,不满仓、不梭哈

我们建议 新手先低杠杆(1-2x)或现货运行,熟悉策略后再逐步调整。

这个策略的目标是 长期跑赢大盘,控制回撤,保持稳定增长,而不是追求一夜暴富。

📢 Final Summary

This strategy is based on real market data and validated through long-term backtests under near-live conditions. It features high trade frequency, robustness, controlled risk, and strong return potential. Ideal for small to mid-capital quantitative traders, especially for BTC, ETH, and major crypto pairs in short-term trading. It is also an excellent reference for crypto quant enthusiasts and strategy developers.

Specter Strategy, Crypto Quantitative Trading, BTC Quant Strategy, ETH Trading Strategy, Short-Term Trading, Quant Backtesting, Crypto Trading Strategies, Stable Profit Strategies, Low-Drawdown Quant, High-Frequency Crypto Trading

✅ This is the fully translated English version, preserving your format and technical details exactly. Do you want me to also add a short intro tagline like:

Specter Strategy V1 – “Strike Fast, Disappear Like a Ghost” to make it more branded and professional? Or keep it formal?